- Tailored cover

- Legal helplines

- Significant limits of indemnity

Legal Expenses Insurance

Cover for the costs associated with legal proceedings and expenses.

- Cover for individuals, families, or businesses

- Cover for wide range of areas including tax investigation and property disputes

Legislation and litigation are, unfortunately, common words in the business world. Coupled with the rise of no-win-no-fee solicitors, Britain has spiralled into a compensation culture.

On a daily basis, there are many activities we undertake that can go wrong and lead to a legal issue so it is important that you are in a position of financial strength to either defend or pursue an action.

With even the most junior of legal staff commanding over £100 an hour, the cost of legal action is high, luckily legal expenses insurance can provide the cover you need.

The Alan Boswell Group Difference

Whether you are an individual or a commercial business owner we will provide expert advice on your requirements. Legal advice is not cheap and it is essential to ensure you have the right cover in place should a legal issue arise. We work with a selection of specialist legal expenses insurance companies and will recommend and advise on cover reflective of your needs. Our policies are some of the most comprehensive around whilst remaining competitively priced.

As a business insurance broker we have access to a wide range of products, so we can provide you with the best solution for your business. Add to this service our outstanding in-house claims team and risk management solutions and you have your ideal insurance partner.

Legal expenses insurance in detail

Commercial legal expenses

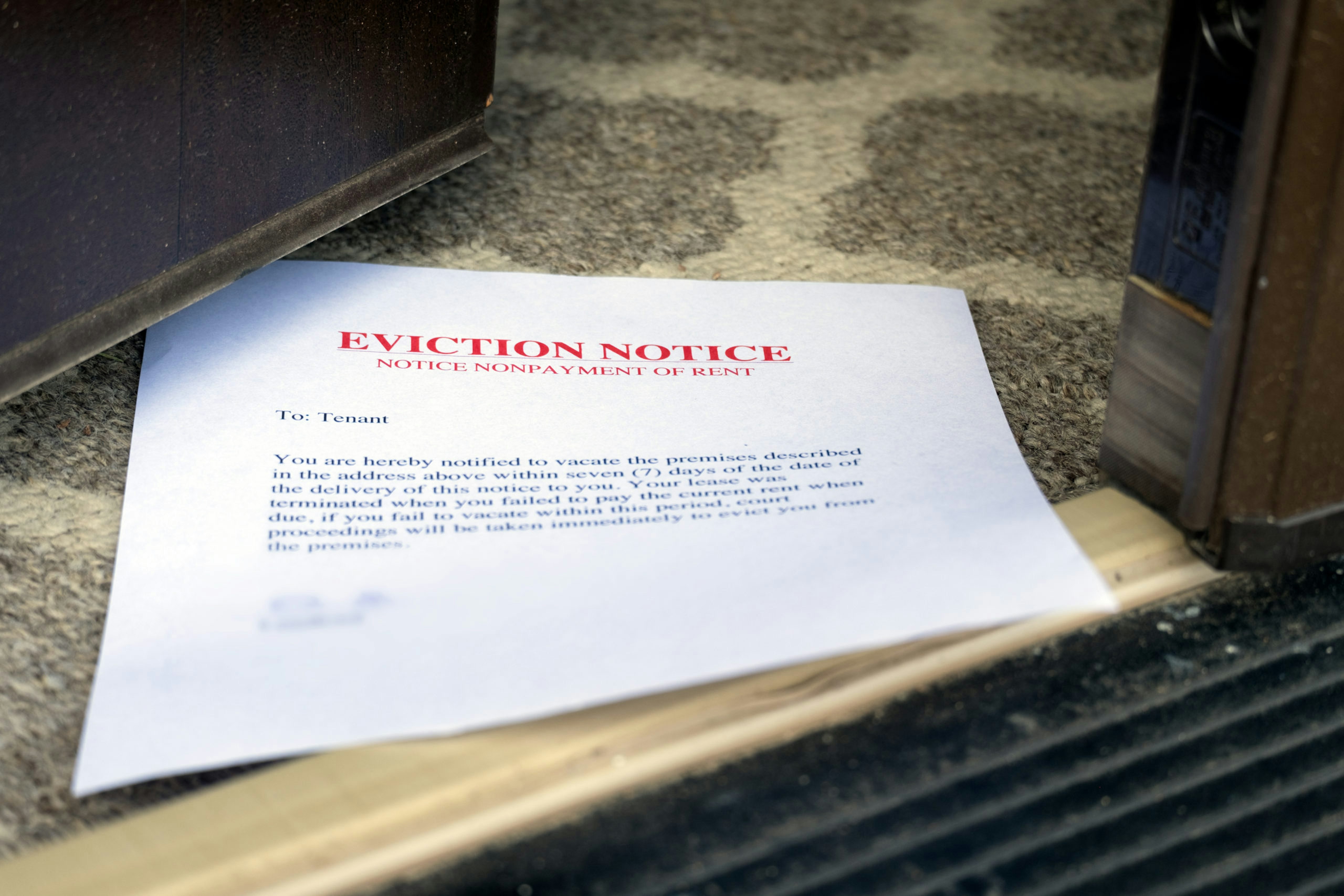

Landlord legal expenses

Motor legal expenses

Family/home legal expenses

Each legal expenses insurance policy will differ and it is important you seek expert advice on what policy is right for you.

If you use your own solicitor it is important to check what the conditions of your policy are, as some policies will require use of their own solicitors.

FAQs

Get in touch

Whether you need a quote, have a general enquiry, want to register a claim, or want to talk it through over the phone, we're here to help.