- Access to legal advice helpline

- Tax investigation cover

- Property disputes legal cover

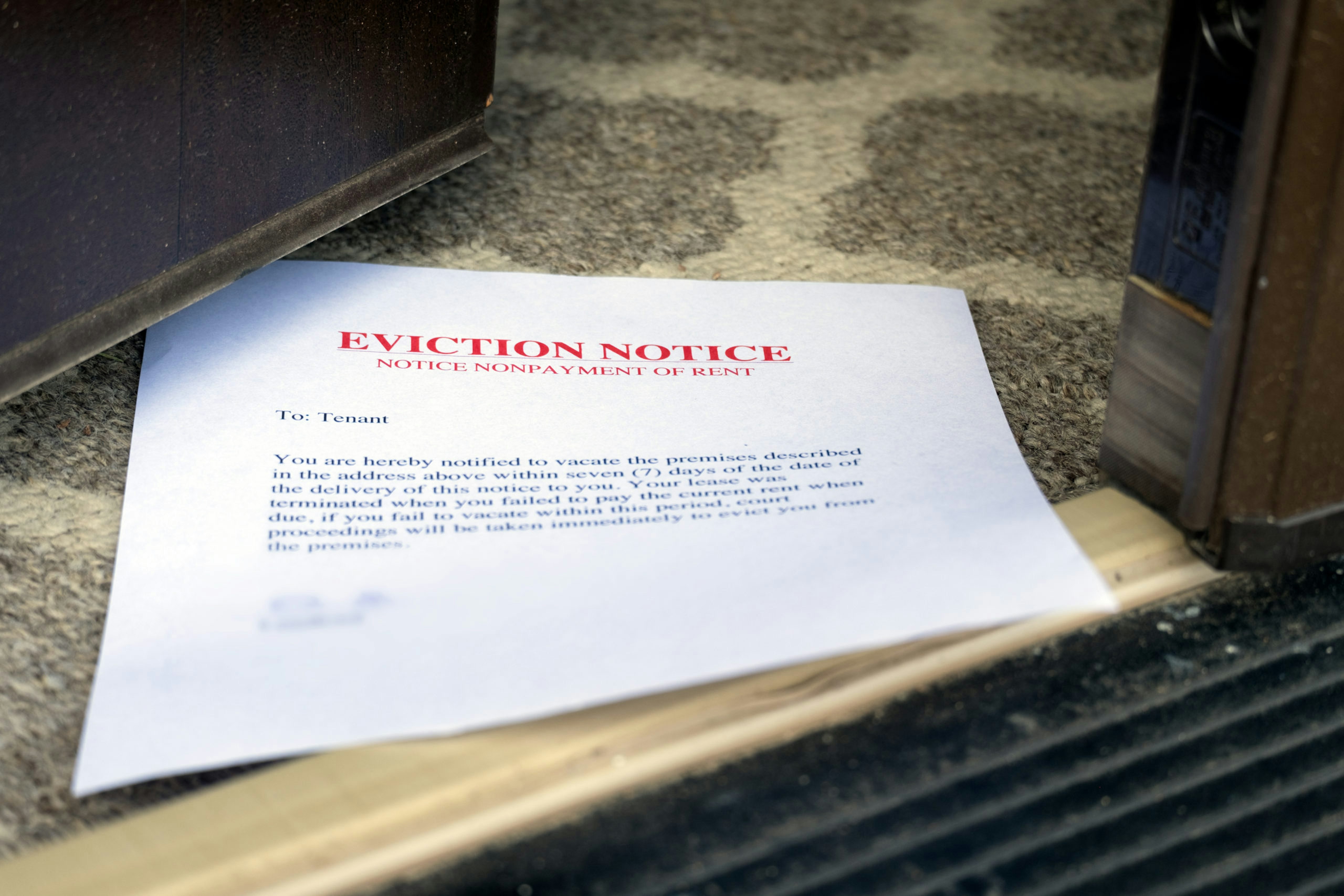

Landlord Legal Expenses Insurance

Covers landlord's legal costs for tenant disputes, evictions, and property damage claims, safeguarding you against high legal fees.

- From £60 a year per tenancy

- £100,000 legal expenses cover (including eviction costs)

Landlord legal expenses insurance provides legal advice and cover for legal costs should a dispute relating to your property and tenant(s) arise, such as legal action and court proceedings, up to £100,000. For example, you can benefit from having legal expenses insurance if a tenant damaged your property, if you need to evict your tenant(s), or if you wanted to seek unpaid rent.

Landlord legal expenses cover is essential for landlords who want to keep control of their property at all times. Usually tenancies run smoothly and there is little cause for concern, however, when it does go wrong there can be lengthy and costly legal disputes.

The Alan Boswell Group Difference

We appreciate that when you’re letting a property there needs to be a continuous income flow. If something jeopardises this income, action needs to be taken quickly. That’s why we have worked to develop landlord legal expenses cover; a product that covers the major legal issues a landlord could face and provides support so situations are remedied quickly and efficiently.

Our landlord advice hub is full of useful information to help landlords and property owners find the advice and products needed.

Landlord legal expenses insurance in detail

Eviction cover

General property disputes cover

Repair and renovations disputes cover

Health & safety prosecutions

Tax investigation cover

Rent recovery

Access to legal advice

Removal of squatters by interim possession order

Replacement of locks following legal eviction by bailiff or sheriff

Storage of tenant’s goods following legal eviction by bailiff or sheriff

If tenants already occupy the property and you wish to take out this policy midway through their tenancy there will be a 60 day exclusion period before any claim can be submitted.

FAQs

Get in touch

Whether you need a quote, have a general enquiry, want to register a claim, or talk it through over the phone, we're here to help.