Speak directly to our team

01603 216399Home emergency cover is vital in a crisis, especially for landlords and homeowners. That’s why Alan Boswell Group provides swift and effective assistance when a domestic emergency occurs. We offer landlords and tenants a reliable service, fully qualified engineers, and a speedy, helpful response. The cover includes plumbing and drainage problems, failure of utilities, infestation of vermin, and damage caused to external locks, doors or windows, rendering the property insecure.

- From £135 per property or flat with no excess.

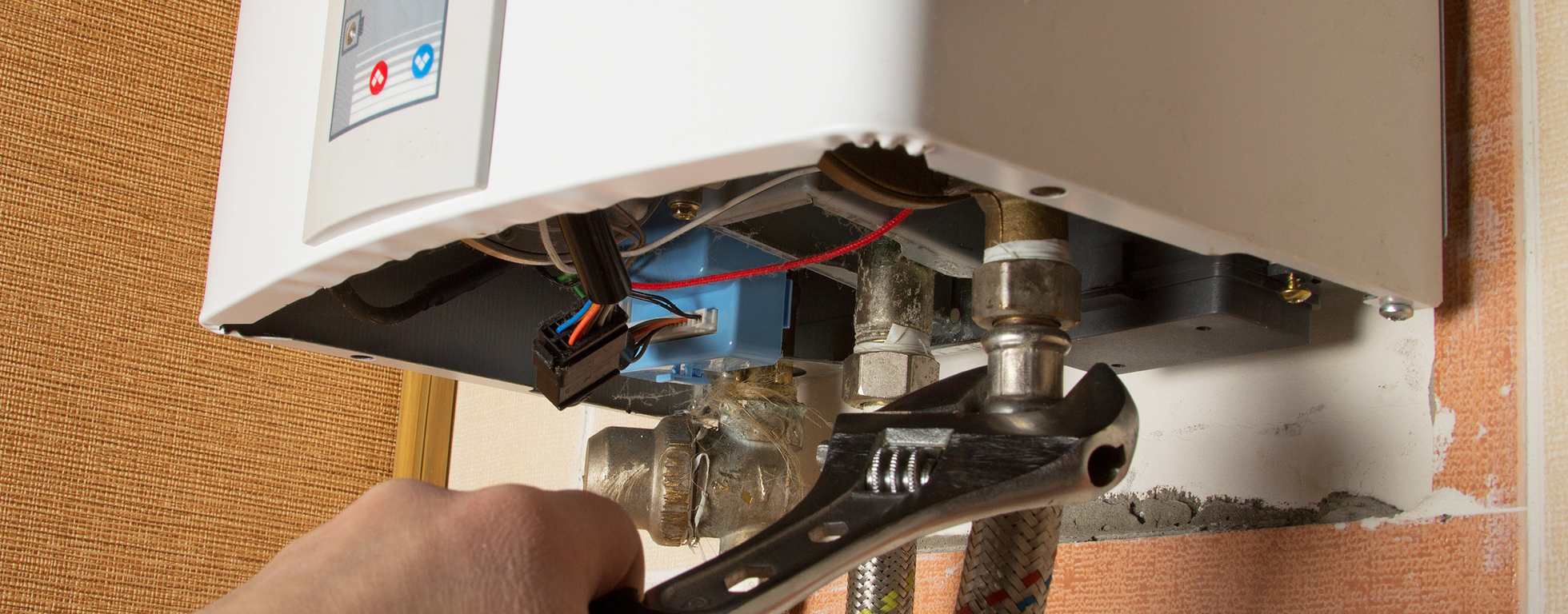

- Cover for domestic emergencies including boiler breakdown.

- Unlimited number of claims (up to £500 per claim).

- 24/7 emergency helpline (even on Christmas day).

The Alan Boswell Group Difference

We have worked with landlords and homeowners for more than 30 years and our Home Emergency Cover has evolved meet the needs of our clients. Many policies will limit usage of the policy and restrict what is classified as an emergency. Our policy provides wide cover, whether you are a homeowner or landlord with one or multiple properties.

We also have a landlord advice hub that is full of useful information to help landlords and property owners find the advice and products needed.

How our customers rate us

Helpful, quick, professional service. Thank you

Home Emergency Cover in detail

Defining what is a domestic emergency can be subjective. Here’s what’s covered by home emergency insurance:

- Heating Cover for complete failure or breakdown of either the heating and/or hot water supply.

-

Plumbing

Cover for sudden failure of, or damage to, the plumbing and drainage system.

-

Utilities

Cover for sudden and complete failure or breakdown of the electricity or gas supply.

-

Alternative accommodation

Up to £250 costs for alternative accommodation if your house is uninhabitable as a result of a claim.

-

Storm

Damage to the roof of your property caused by storm, fallen trees, and branches.

-

Security

Damage caused to external locks, doors, or windows leading to an unsecured property.

- Infestation Cover for infestation of vermin.

This product is designed to be used in the event of a domestic emergency and is not a maintenance contract.

Home emergency cover can only be purchased if you hold either home or landlord insurance through Alan Boswell Group.

What is not covered?

-

Boiler systems over 15 years old, or with output of more than 60 kilowatts.

-

Any domestic emergency in a property that has been unoccupied for more than 30 days.

-

Failure of boilers or heaters that have not been maintained, inspected, or serviced by a qualified person within the last 12 months.

-

Any claims arising within the first 14 days of the policy start date.

FAQs

-

The definition used is: “an insured event that makes your home uninhabitable.” e.g. you can’t secure the property, can’t heat the property etc.

-

No, callouts are unlimited.

-

You can claim up to £500 per incident including parts, labour, materials, and VAT. Claims for alternative accommodation are capped at £250.

-

No, home emergency cover can only be purchased if your own or let property is insured via Alan Boswell Group. To get an understanding of how much you’d pay, take a look through our landlords insurance statistics page.

-

No, cover is only available for UK properties.

-

You can claim up to £250 towards the cost of a replacement boiler.

Get in touch

Speak directly to our team

01603 216399Related products

Landlords Insurance

Flexible landlords insurance products from a market-leading broker. Compare quotes for your buildings, contents, and liability insurance for commercial or residential properties.

Landlord Building Insurance

Landlord building insurance is a vital cover for your rental property we can search the market, compare quotes, and arrange your insurance so you get the best cover available.

Home Insurance

Cover for the buildings and contents of your home for damage, theft, and other covers.

Landlord Contents Insurance

Our landlord contents insurance is for the properties you have left fully or part-furnished and provides cover for the furnishings, fixtures and fittings.

Landlord Legal Expenses Insurance

Provides cover for your rental property, including repossession of the property and other legal disputes.

Rent Guarantee Insurance

Provides insurance for non payment of rent in the event of a tenant defaulting as well as any landlord legal expenses cover of up to £100,000.

Multi Property Landlord Insurance

Multi-Property landlord insurance for your residential and/or commercial property portfolio.

Block of Flats Insurance

A comprehensive flat insurance policy tailored to your requirements will give you peace of mind, talk to one of our specialists today or get a quote online

Landlord Legal Expenses Insurance

Provides cover for your rental property, including repossession of the property and other legal disputes.

High-Value Home Insurance

Covers properties with higher value than average contents and buildings sum insured. This may include works of art and specific high-value items.

Related news

Guide to renting out a property furnished or unfurnished

Are you unsure whether it’s best to let your property furnished or unfurnished? Our guide looks at the pros, cons, and implications for both kinds of let.

Legal requirements when letting a holiday property

Owning and managing a holiday let comes with a number of responsibilities. To help you meet your obligations and stay on the right side of the law, we explore the legal requirements for renting out a holiday home.

Landlord’s guide to government deposit schemes

When a landlord takes a tenant’s deposit, the money must be protected in one of the government-backed deposit schemes. We explain how these schemes work and what your obligations are.