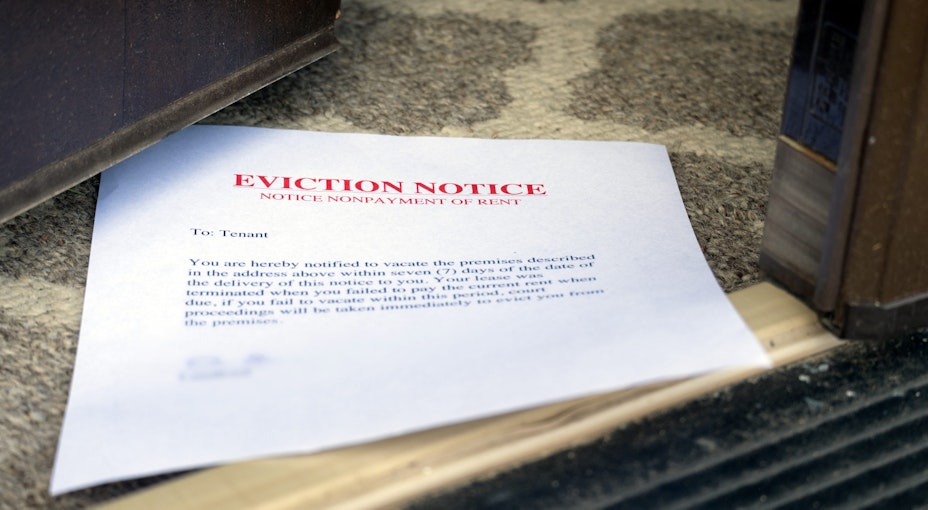

How do you evict a tenant?

25.05.21

This content was factually correct when written but may not reflect current developments or information.

It can be tough when a tenancy doesn’t work out and you’re left facing a problem tenant. Luckily, there are a couple of ways for landlords to regain possession of their properties. Here, we explore the reasons for evicting a tenant and the practical steps you can take to get your rental property back.

We’ve broken it down into the following sections so you can quickly find the information you need:

How to evict a tenant

Most tenancies in England and Wales agreed after January 1989 are officially known as assured shorthold tenancies. Under these types of tenancy agreements, there are two main ways you can evict tenants – through a Section 8 or Section 21 notice, which we’ll go on to examine in more detail.

For other types of tenancies, different eviction procedures apply. This includes, excluded tenancies where a lodger lives with you and assured tenancies which started between January 1989 and February 1997. You can find out more about evictions for these particular types of tenancy at GOV.UK, evicting tenants.

If you need to evict a tenant, it’s crucial to follow official procedures and you cannot evict a tenant forcibly yourself. As a landlord, you have several responsibilities and an obligation to respect your tenant’s rights no matter what the situation.

When can you evict a tenant?

The most common reason for evicting a tenant is rent arrears. If this is the case, you must wait for tenants to miss at least two months’ worth of rent before you can start the eviction process.

You might also decide to evict a tenant for other reasons, such as breaching their tenancy agreement, antisocial behaviour or taking part in criminal activities.

In some cases, there may be no reason at all, other than you no longer want to rent your property and want it back.

If you choose to go down the eviction route, it’s important to be clear about why you want your tenant removed, because this can affect the way in which you evict them.

How can landlords end a tenancy agreement?

As we briefly touched on earlier, there are two ways to evict a tenant:

Issue a Section 21 tenant eviction notice

Also known as a ‘no-fault’ eviction. As the name suggests, your tenants don’t need to have done anything ‘wrong’ for you to issue a Section 21 notice.

Section 21 evictions simply let your tenant know that you want the property back at the end of their tenancy. You don’t have to give any reason for eviction, but it could be because you want to move in yourself, renovate, or sell it.

The earliest you can issue a Section 21 notice, is four months after the tenancy start date. You also need to give your tenants at least two months’ notice if they pay their rent monthly. The notice period increases if rent is paid quarterly or annually.

Section 8 tenant eviction notice

If you need to evict your tenant before their tenancy comes to an end, you could issue a Section 8 notice – but only in certain circumstances.

Under Section 8, you can choose from 17 reasons for eviction, these are split into mandatory grounds and discretionary grounds. You can list as many reasons as you want but they must be valid, so you’ll need to provide evidence to support your case.

Grounds for eviction under Section 8 include:

Rent arrears of more than two months.

Repeatedly late rental repayments.

The tenant has neglected the property.

The property was rented as part of a job and that job has ended.

The tenant provided false information to gain the tenancy.

Ensuring your eviction notice is legally valid

For your Section 21 or Section 8 tenant eviction notice to be valid, it must be completed properly. For example, your tenant’s name must be spelt correctly and if you have more than one tenant, you’ll need to issue each of them with a Section 8 notice. For more details and how to issue either of these, head to our guides on Section 21 and Section 8 notices.

Read more: Landlord’s guide to notice of abandonment

What is the eviction process?

A Section 21 or Section 8 notice will specify when the tenant needs to leave the property. If they don’t, you’ll need to go to court and apply for either a Standard Possession Order or an Accelerated Possession Order.

When to apply for a Standard Possession Order

You’ll need to apply for this if your tenant owes you rent. When you submit your claim, you’ll need to wait for your case to be heard in court. Bear in mind you’ll need to go to the hearing or have someone represent you.

In most cases, you can log your claim online which also means you can track its progression. Currently, this service costs £355.If your case is more complicated and your tenants have broken terms within their tenancy agreement, you’ll need to physically fill in the relevant forms. To find out more and access the online service, go to GOV.UK, standard possession orders.

When to apply for an Accelerated Possession Order

You can only apply for an Accelerated Possession Order if you issued a Section 21 notice. These skip the court hearing stage so can be much quicker compared to a Standard Possession Order.

Remember that you can only apply for this type of order so long as your tenant does not owe you rent. To apply, you’ll need to download and fill in one of these forms from GOV.UK, accelerated possession orders.

What happens if tenants don’t leave after a possession order?

If tenants still won’t leave even after a possession order, the final stage is to apply for a Warrant of Possession. This is a formal notice from the court to your tenant, instructing them to leave by a certain date.

If they decide not to leave your property, a bailiff can enforce the eviction. If your tenants are forcibly removed, it’s a good idea to have a locksmith onsite who can change the locks for you there and then.

If you applied online for a possession order, you can also apply for a warrant online at GOV.UK, eviction notices and bailiffs.

Read more: Guide to landlord risks | The cost of being a landlord

Are eviction rules different in Scotland and Northern Ireland?

Evictions in Scotland and Northern Ireland are slightly different than those for England and Wales.

Evicting a tenant in Scotland

In Scotland, landlords must have grounds for eviction. There are 18 grounds you can choose from and you must set out the reason for eviction in a formal Notice to Quit. This should also include the date your tenant must leave by, but this will be determined by the length of time your tenant has been in the property.

If your tenants don’t leave, you’ll need to go to the First-Tier Tribunal for Scotland and apply for an eviction notice. For details, go to MyGov.Scot, ending a tenancy.

Evicting a tenant in Northern Ireland

In Northern Ireland, you’ll need to issue a written Notice to Quit. Like Scotland, the length of notice will depend on how long your tenant has been in the property.

If you’re evicting a tenant within their tenancy term, you must give a reason for doing so (and have relevant evidence). If their tenancy has expired but is ongoing on a rolling basis, you won’t need to give a reason for their eviction.

If your tenants don’t leave after a Notice to Quit has been issued, you’ll need to go to court to get a possession order. If that isn’t effective, you should issue a Notice of Intent to Enforce, which gives your tenants 10 days to respond. After that, the last stage is to make an Application for Full Enforcement which means an enforcement officer recovers your property. Find out more at Housing advice for NI, right to evict.

How to write an eviction letter

You should send your tenant written notice of your intention to evict them. Your letter should include:

The tenant’s name.

The address of the property you want to evict them from.

Under what terms you’re evicting them – for example, Section 21 or Section 8.

If you’re arranging an eviction under Section 21, you may also want to specify a date to carry out a property inspection or inventory check.

How can landlord insurance help with tenant evictions?

It’s not easy being a landlord and it can be particularly difficult if you end up with troublesome tenants. The good news, is that the right landlord insurance can help you navigate tricky situations, like evictions.

At Alan Boswell Group, we offer award-winning landlord insurance products that can mitigate your financial losses, including rent guarantee, and landlord buildings and contents cover. Our legal expenses cover will also safeguard your interests by providing dedicated legal advice in case of disputes and eviction.

Our Tenancy Application is interactive and it can be really helpful in ensuring that you have all the important information you need about potential tenants before you decide to rent out your property. This can help you find the perfect tenants who are just right for your property.

Need help with your insurance?

Whether you need a quote, have a general enquiry, or want to talk it through over the phone, we're here to help.

Landlord insurance enquiry

Related guides and insights

A guide to the Tenant Fees Act 2019

Since the Tenant Fees Act was passed in 2019, the fees charged by landlords and lettings agents have been severely restricted. In this guide, we show you which fees are still allowed – and which can put you on the wrong side of the law.

A landlords guide to sitting tenants

Sitting tenants can complicate a sale, but that doesn’t always have to be the case. We explore how sitting tenants can affect your property and what you can do to make the sale process as smooth as possible.

The UK guide to commercial tenant eviction

A comprehensive guide to evicting a commercial tenant and regaining possession of your property.

Finding good tenants | A landlord's guide

Every landlord wants to find good tenants for their buy-to-let properties. In this article, we share our tips and tricks for attracting responsible and pleasant tenants – and avoiding those ‘tenants from hell’.