Your guide to the personal injury discount rate

The Personal Injury Discount Rate (PIDR) is a figure used to adjust lump sum compensation payments for high-value personal injury and clinical negligence claims. This figure is set by the Lord Chancellor in England & Wales, and separately for Scotland and Northern Ireland by the Government Actuary.

By Alan Boswell Group

The current personal injury discount rates in the UK are:

England & Wales: +0.5% (since 11 January 2025)

Scotland: +0.5% (since 27 September 2024)

Northern Ireland: +0.5% (since 27 September 2024)

How the Personal Injury Discount Rate works: the principle of 100% compensation

The principle behind a personal injury settlement is that it should leave a successful claimant in the same financial position as if the injury had not occurred. It should also compensate for any changes to their lifestyle caused by their injuries, known as “loss of amenity.” Each case is different, but this might include:

Loss of future earnings

Cost of care, treatment, medical aids or home adaptations

Access or mobility changes

PIDR works on the assumption that any lump sum that’s awarded will be invested, and that the income from this investment will meet 100% of these future losses. Therefore, if future losses are calculated at £500,000, the lump sum, combined with its projected gains (or losses) over the relevant period, must equate to £500,000.

The PIDR is therefore set to reflect an assumed investment return, taking into account factors such as the return rate from a low-risk portfolio, inflation, and taxation.

In essence, the higher the PIDR, the lower the lump sum that’s needed. The lower the rate (especially when it’s a negative percentage), the higher the initial lump sum required.

The PIDR is used to calculate future (not past) losses in personal injury claims. Often these settlements are covered by vehicle or motor fleet insurance, public liability insurance or employer’s liability insurance policies. Alternatively, an insurer may come to an agreement with the victim to arrange a structured settlement annuity. Instead of making a lump sum payment, structured settlements make regular, tax-free payments over a defined period. Again, an annuity would be set up to reflect the discount rate and changes in inflation for the lifetime of the agreement.

The current discount rates across the UK

The table below shows the current PIDR rates across the UK. While they are currently aligned, it’s important to note that they are set independently.

|

Jurisdiction |

Current rate |

Effective from |

Previous rate |

|---|---|---|---|

England & Wales |

+0.5% |

11 January 2025 |

-0.25% |

Northern Ireland |

+0.5% |

27 September 2024 |

-1.5% |

Scotland |

+0.5% |

27 September 2024 |

-0.75% |

The practical impact on claims: a worked example

Let’s take a simplified example of how the PIDR affects the lump sum payable to a successful claimant. Real-life awards utilise the latest Ogden Tables (UK actuarial tables) to model life expectancy, schedule of losses, residual earning capacity, and other relevant factors. These tables translate assumptions into multipliers or discount factors.

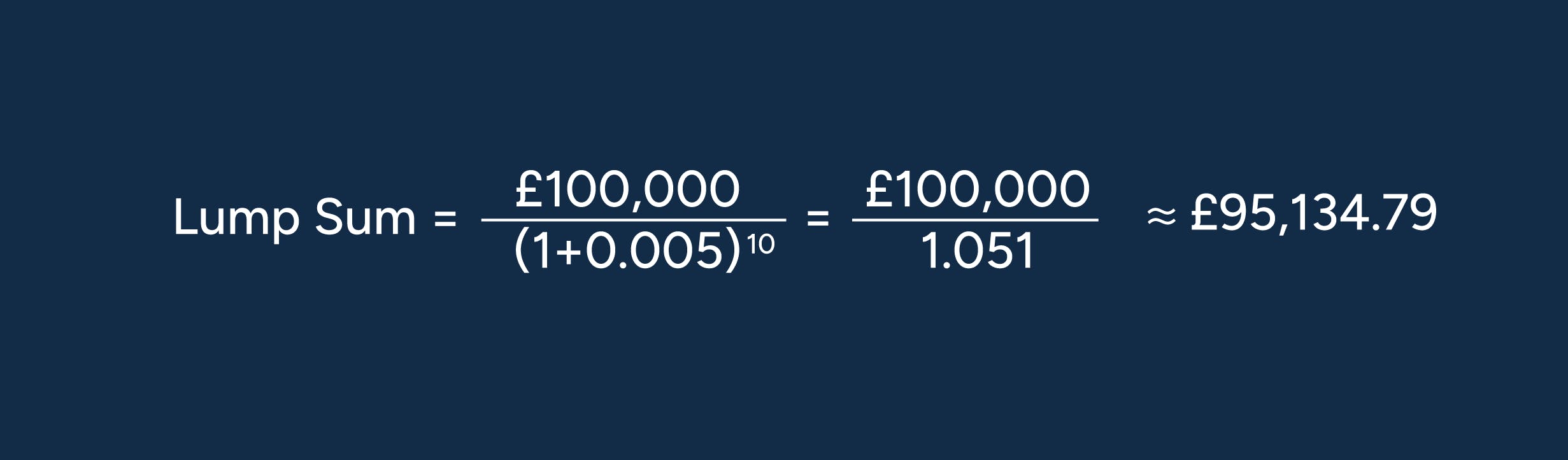

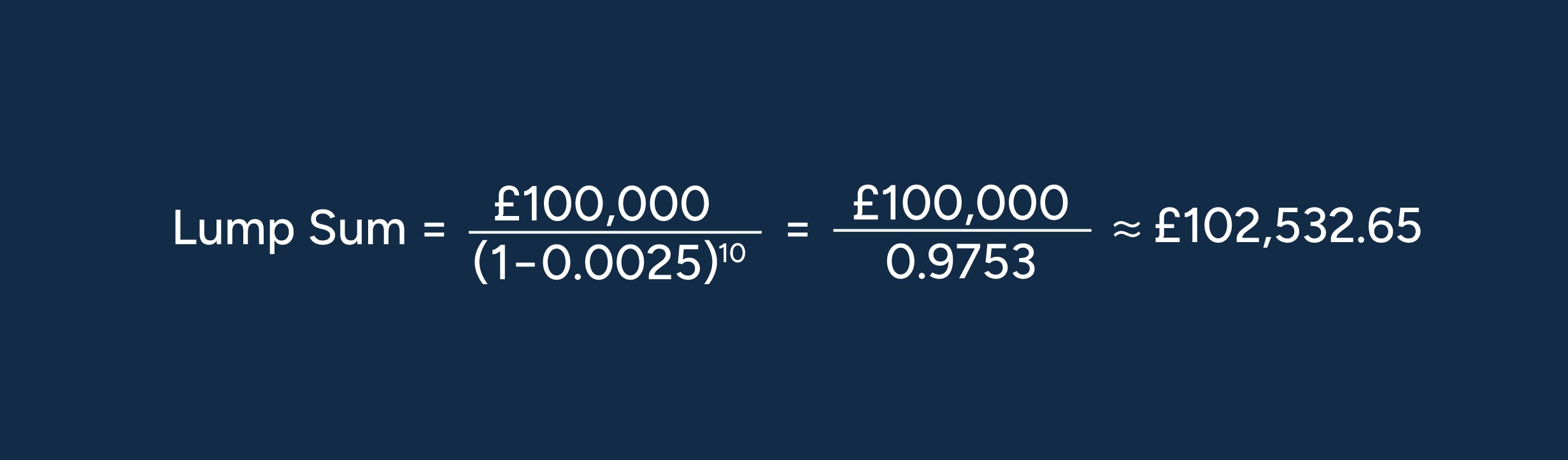

In our basic scenario, a claimant is entitled to £100,000 in future financial losses (for example, loss of earnings or care costs) over a ten-year period.

We’ll calculate the present-day lump sum equivalent under two Personal Injury Discount Rates (PIDR):

+0.5% (current rate in England & Wales, effective from 11 January 2025)

-0.25% (previous rate, effective from 5 August 2019)

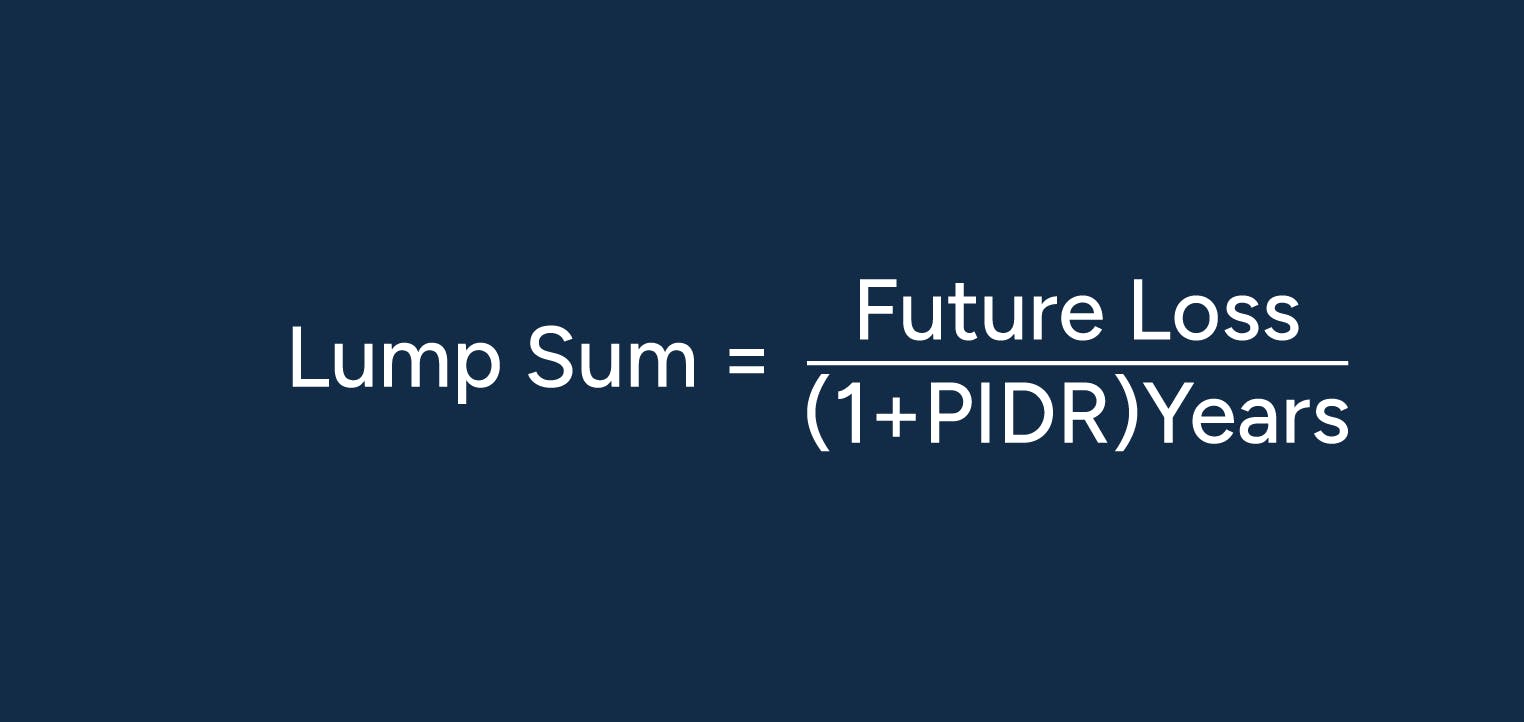

To determine the lump sum equivalent, we will use the following formula:

Calculation at +0.5% (current rate)

At a positive PIDR of +0.5%, the claimant would receive a lump sum of approximately £95,134.79 now, which would grow (through assumed investment returns) to £100,000 over 10 years. The higher the discount rate, the smaller the initial award required.

Calculation at -0.25% (previous rate)

At a negative PIDR of -0.25%, the lump sum increases to approximately £102,532.65, as the assumed investment return is negative, meaning the sum is expected to lose value over the ten-year period. Therefore, a higher upfront payment is required to ensure the claimant remains fully compensated.

Avoid this common mistake!

When applying the PIDR, always remember that the rate is expressed as a percentage, not a whole number.

For example:

+0.5% should be written as +0.005 in the formula

-0.25% should be written as -0.0025

Using 0.5 instead of 0.005 would assume a 50% annual return — dramatically overstating the investment growth and reducing the lump-sum award to a fraction of its correct value.

The history of the PIDR and its impact on insurance

The discount rate was introduced under the Damages Act 1996 and originally applied to all jurisdictions of the UK. In England and Wales, the Lord Chancellor fixes the discount rate. In recent years, Scotland and Northern Ireland have had separate PIDRs set by the Government Actuary.

Originally, the PIDR was to be set within a range of 0% to 5%, but this was later changed to a range of -2% to 3%. In England and Wales, the PIDR remained at +2.5% from 2001 to 2017, when it dropped to -0.75%. It increased to -0.25% in 2019 and then to 0.5% in 2025. In other words, payable lump sums increased dramatically in 2017 and have since decreased as the rate has risen again.

PIDR and premiums

As the discount rate affects the level of claims settlements that insurers will have to make, any changes will inevitably affect insurance premiums, both positively and negatively, depending on the current rate.

As the PIDR is now +0.5% across all UK nations, this materially lowers lump sum awards for future losses. For legal professionals, actuaries and claims handlers, this shift from negative to positive rates is a key development. That said, be sure to keep an eye out for future rate changes – even the smallest change in the PIDR can have a significant knock-on effect on payouts.

Need help with your insurance?

Whether you need a quote, have a general enquiry, or want to talk it through over the phone, we're here to help.

Make an enquiry – general and locations

Related guides and insights

Public Liability vs Professional Indemnity insurance

One of the questions we’re most often asked is about the difference between public liability and professional indemnity insurance. In this article, we explain how these policies work.

Your guide to Public Liability insurance

We answer your commonly asked questions in our guide to Public Liability insurance, including what it is, who needs it and how much it typically costs.

Litigation and the cost of employment related claims are on the rise; have you considered Employment Practices Liability (EPL) Insurance?

What is Employment Practices Liability Insurance (EPL) and why does your business need it?